Important Dates, Forms & Brochures

Important Dates for Assessment and Taxation:

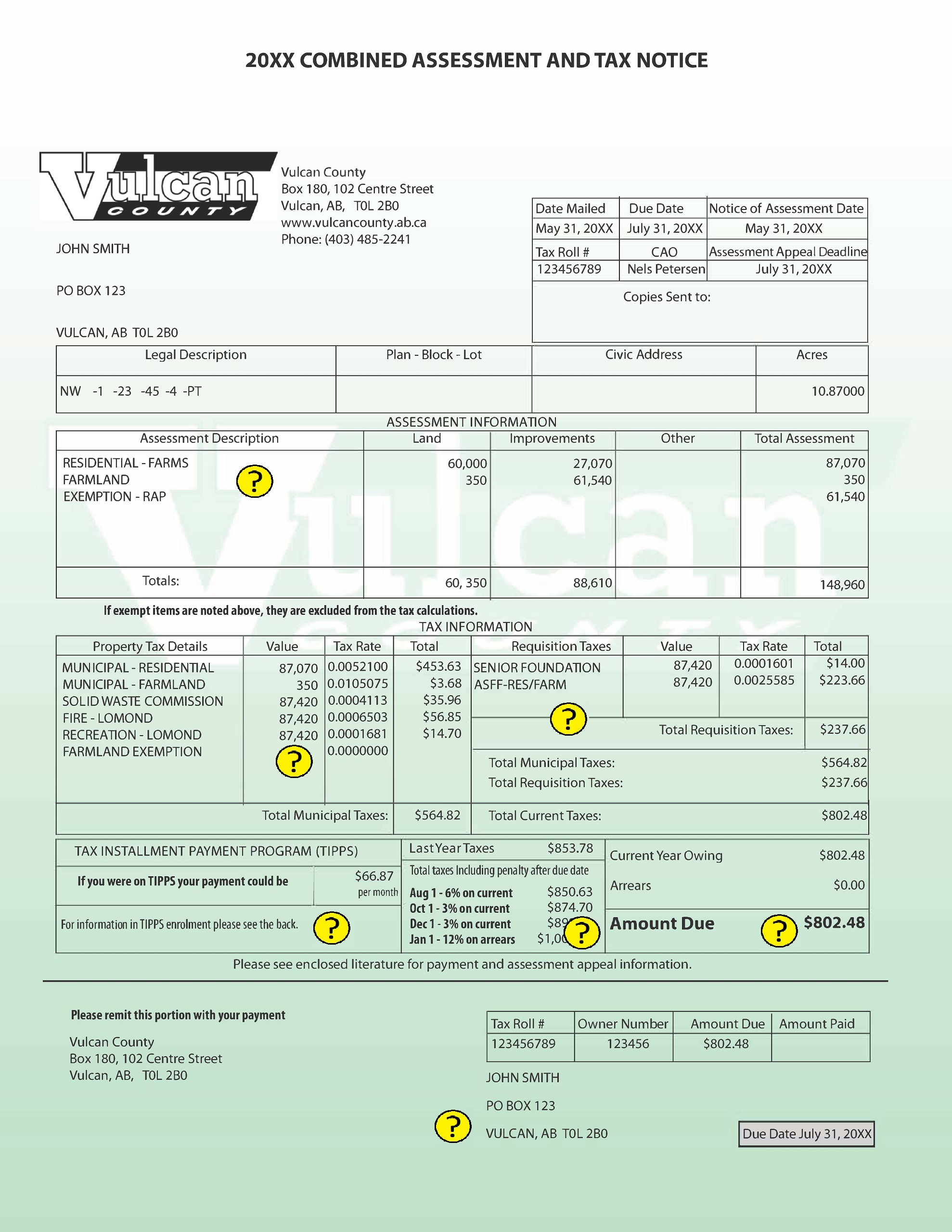

There are many important dates and deadlines that relate to assessment and taxation. The following are the dates relating to the 2024 tax levies:

2023

– July 1st – Assessments for the upcoming tax year are based on the value your property would likely have sold for on the real estate market as of this date.

–December 31st – Any changes in physical condition of your property as of this date are factored into your property assessment.

2024

–April / May – County Council approves the Municipal Operating and Capital Budget and finalizes the Provincial Education, Marquis Foundation, and the Municipal property tax rates.

–On or before May 31st – The Combined Assessment and Tax Notices are mailed out and the Assessment Roll is open for viewing.

-July 1st – Deadline to apply for the Tax Instalment Payment Plan (TIPPs) for the current year tax levies (must have no tax arrears outstanding).

–July 31st – Deadline to appeal the assessment value of your property with the local Assessment Review Board (ARB). The Assessment Roll is closed for viewing. Deadline to pay property taxes.

–August 1st – Penalty of six percent (6%) on unpaid current year taxes outstanding.

–October 1st – Penalty of three percent (3%) on unpaid current year taxes outstanding.

–December 1st – Penalty of three percent (3%) on unpaid current year taxes outstanding.

2025

-January 1st – Penalty of twelve percent (12%) on all unpaid tax arrears outstanding.

Forms & Brochures:

The following are multiple forms, brochures, and other information prepared by the County to try to assist in providing our ratepayers information relating to Taxation and Assessment: