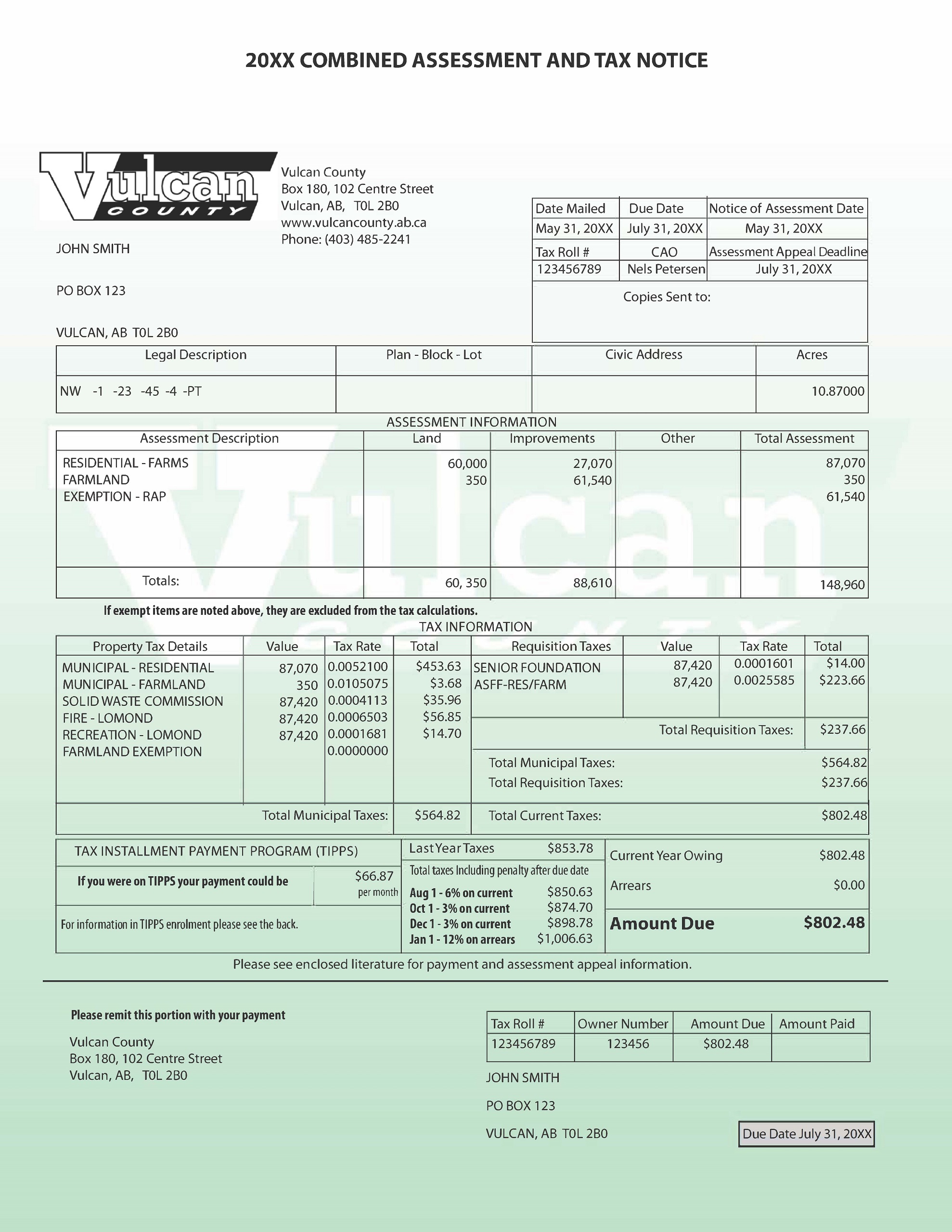

Assessment Information - There are many different property tax classifications used by Vulcan County; for example, Farmland, Residential and Non-Residential. The assessed values are typically a reflection of the market value of the property as of July 1st of the prior year and must also reflect the characteristics and physical conditions of the property as at December 31st prior to the year in which the taxes are imposed is subject to Provincial legislation and has no municipal government influence.

Some properties may have certain assessment exemptions which are not subject to taxation. As shown in the example, there is an assessment description referred to "EXEMPTION - RAP" which is a regulated exemption on farmland. If there may be an exemption on your Tax Notice, there will be a note indicating that "If exempt items are noted above, they are excluded from the tax calculations".

If you have questions relating to your assessment, please see Property Assessment & Taxes brochure or contact Logan Wehlage at 403-381-0535 or by e-mail This email address is being protected from spambots. You need JavaScript enabled to view it.. The assessment appeal deadline is July 31st after the tax notices are issued.

Property Tax Details - This section uses the classifications and assessment values noted above to determine the property taxes. These taxes include the municipal portion (funds required for County operations), the contribution to the Vulcan and District Waste Commission, and the fire and recreation districts. The municipal portion is determined by the specific assessment values based on the property tax classifications (excluding any exemptions) and is used to generate the required funding to operate the County according to the Council approved budget.

As per the example:

- Residential taxes referred to as "MUNICIPAL - RESIDENTIAL" are based on the total assessment of the "RESIDENTIAL - FARM" of $87,070

- Farmland taxes referred to as "MUNICIPAL - FARMLAND" are based on the total assessment of the "FARMLAND" of $350

- The "EXEMPTION - RAP" is the assessment exemption, which is not included in any of the tax calculations

- The remaining tax levies of $87,420 are based on the total assessment for the property of $148,960 less the exemption of $61,540 (which also equates to the $87,070 residential plus $350 farmland).

The contribution to the Vulcan and District Waste Commission (SOLID WASTE COMMISSION) is based on the funding requisition that the Commission provides to Vulcan County. The contributions to the fire and recreation districts will depend on the amount of funding that was requested and approved from your specific district (there are six districts within the County, each with different tax rates).

Requisition Tax Information - This section relates to the taxes that are requisitioned external to the County. The Marquis Foundation (SENIOR FOUNDATION) and the Alberta School Foundation Fund (ASFF) have requisitioning powers, and as such, Vulcan County is obligated to pay these requisitions (Council has no authority to adjust their requisition). All municipalities throughout the Province of Alberta are required to levy charges on all assessable property (other than Machinery and Equipment for ASFF requisitions). The County collects the ASFF tax levy on behalf of the Province, and forwards the funds quarterly. Typically, the ASFF requisition represents approximately 25-30% of your total taxes.

Recently, additional requisitions required to be collected by the County including the Royal Canadian Mounted Police (RCMP) and a Designated Industrial Property (PID) for specific DIP property types.

Tax Installment Payment Program (TIPPS) - Vulcan County offers a Tax Installment Payment Plan, where monthly payments are automatically withdrawn from your bank account. To obtain information on enrolment, please visit our Tax Installment Payment Plan (TIPPs) for additional information.

Your property Tax Notice will indicate whether you are already enrolled in TIPPS. In this example, John Smith is not on TIPPS, therefore it indicates that "If you were on TIPPS your payment could be" and indicates the monthly payment of $71.15. Note that this amount is based on an January 1st enrolment, if you enroll later in the year this figure is adjusted. If you are already enrolled in TIPPS, the Tax Notice will indicate what the "Revised monthly tax payment" would be.

Amount Due - This section indicates the total amount that is owing to Vulcan County, including the current year taxes (and any balances in arrears) which are due by July 31st. The arrears are the amounts owing from prior year’s taxes and related penalties, and any payments made on account will be applied to the oldest balance outstanding. You will not be required to pay the amount due if the balance is already in a credit position (payments made in advance) or if you are enrolled in the TIPPs program (as the remaining balance will be covered by your future TIPPs payments).

Penalties for Late Payment - This section indicates the total amounts owing if the payment is made after the July 31st deadline as per the County’s Payment Due Dates and Penalties Bylaw. On August 1st, a 6% penalty is applied on the total current year taxes outstanding. On October 1st and December 1st, a 3% penalty is applied on the total current year taxes outstanding. If payment is still not received by December 31st, a 12% penalty is applied on January 1st on all balances owing as at that date.

Remittance Advice Slip - The bottom section of the Tax Notice is available to be detached and submitted with your payment. This section is to assist Vulcan County with ensuring that the payments are made to the proper owner and tax roll account (i.e. tax roll number, owner number, amount due, etc.)